Wedgwood goes into administration

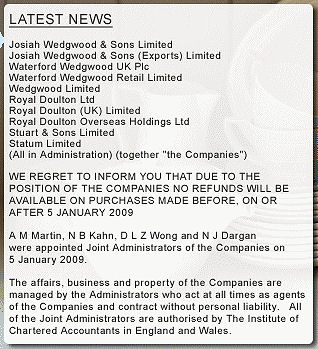

Iconic china and ceramics firm Waterford

Wedgwood has gone into administration after the economic slowdown hit the

debt-laden firm.

Deloitte has been appointed as administrator to seek buyers for different

parts of the company.

It said failed buyout talks and poor trading meant restructuring could not

happen "in an acceptable timescale".

Wedgwood has also requested that its shares be suspended from trading on

the Irish Stock Exchange. And a receiver from Deloitte has been appointed

to Wedgwood's Irish

arm.

"Waterford,

Wedgwood and Royal Doulton are quintessentially classic brands that

represent a high quality product which is steeped in history," said

joint administrator Angus Martin.

The administration team will be working closely with management,

customers and suppliers during this time to ensure operations continue

whilst a sale of the business is sought."

The company will continue to trade as a

going concern.

Manufacturing jobs

Chief executive David Sculley had earlier said he was "disappointed" some

of its UK and Irish subsidiaries had been forced into administration or

receivership.

But he was optimistic that a buyer could be found for the Waterford,

Ireland-based business, known for its Wedgwood pottery, Royal Doulton and

Waterford crystal.

In the UK, Waterford Wedgwood employs 1,900 people - of these, around 600

work in manufacturing at Barlaston, Stoke-on-Trent.

The Irish section has around 800 staff based in Waterford.

In total there are 5,800 employees outside the UK with the biggest

manufacturing centre being in Indonesia, where there are 1500 staff

involved in production.

Wedgwood has been known as an iconic name in British pottery firm for 250

years, with many households in the UK owning one or more of their pieces.

In 1987 it merged with the similarly well-known Waterford Crystal to

create Waterford Wedgwood, an Irish-based luxury brands group.

But BBC business editor Robert Peston has said it is "no surprise" that

the heavily indebted firm has floundered.

"Waterford Wedgwood's

collapse is a resonant event, that speaks of a noxious global squeeze on

consumer spending," he said.

"Almost everything that it manufactures is a nice-to-have rather than a

must-have. "And most of us are thinking twice about shelling out on

nice-to-haves."

Mr Peston said that although Waterford Wedgwood had more history than most

FTSE 100 companies combined, it was not a huge company.

"The brands will surely survive under new owners," added our business

editor.

"However what happens to its manufacturing plant - and that of many other

companies like it - is what matters.

"Even if in Waterford Wedgwood's case there are just a few hundred British

manufacturing jobs at stake, the UK can ill afford to see precious

exporting capacity relocated to low-cost, competitor economies. "

Wedgwood is one of the biggest employers in the

Stoke area, said Kevin Farrell, chief executive of the British Ceramic

Confederation.

"There have been specific problems in the premium dinnerware market and

Wedgwood has not been immune from those problems.

"And we've had the period of the credit crunch where really the

willingness of people to go out and buy premium dinnerware has been more

limited."

'Tireless' efforts

Waterford Wedgwood said it had been focused for some time on the

recapitalisation of the company, and, more recently, "on active

discussions regarding the possible investment in the company as a going

concern".

But the group collapsed after talks over a possible investment in the

business failed and potential lenders' patience ran out.

Sir Anthony O'Reilly, non-executive chairman of Waterford Wedgwood, said

the board had "acted tirelessly in its efforts to resolve the company's

issues as a going concern".

"The principal shareholders have invested in support of this business for

almost 20 years. We are consoled only by the fact that everything that

could have been done, by management and by the board, to preserve the

group, was done."

From the

BBC Internet site - Monday 5th Jan 2009

|

![]()